-

United States on Track to Default on its Debt

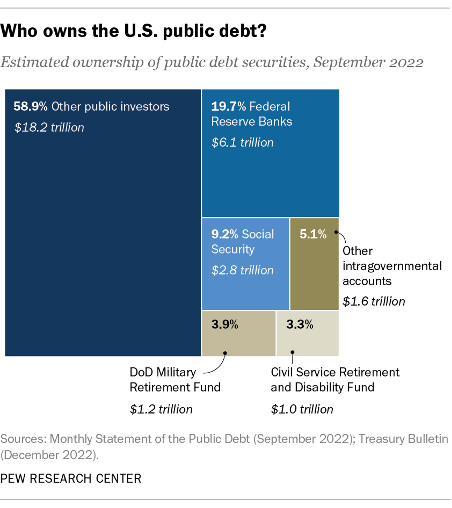

(Figure A)

An economic crisis is imminent if the U.S. Congress does not act before June 2023.

In January of 2023, the United States of America hit its legal federal debt limit, forcing the Treasury Department to enact “extraordinary measures” to deal with the matter for the time being. If no meaningful action is taken by the United States Congress and a default occurs, the consequences will be immeasurably expansive. Consider this fictional scenario, person A takes out a loan of $100,000.00 and spends a total of $150,000.00 (more than originally taken out). Is that a wise course of action? In what world should one spend more than taken out in loans, with that, more harm is being caused. This presented fictional scenario is small in comparison to the debt crisis the United States of America faces, but it represents the situation at hand. The American people should know what is at stake with this crisis.

The federal debt ceiling, also known as the federal debt limit, represents the total amount of money that the United State Government can legally borrow. This amount totals $31.4 trillion, which was reached not too long ago. This ensures that the government can meet its obligations in funding Social Security, Medicare, and other important services. The debt problem and what is at stake for America did not happen overnight. It would be wise to ask, how did we get to this point?

Previous Republican and Democratic administrations are certainly the focal point in answering that question. Irresponsible spending helped spiral the nation’s debt situation out of control. In 2017, former President Trump and the Republican party, along with some Democratic support, put forward reckless spending increases and tax cuts for the highest earners in American society. To raise the federal debt ceiling, the United States Congress must approve such measures before it is sent to President Biden for a signature. The Congress is currently split, with respect to partisan composition; Republicans control the lower chamber (House of Representatives) and Democrats control the upper chamber (the Senate). House Republicans are seizing upon this opportunity to address their wants and needs, by holding the national debt situation hostage. They are using this opportunity to force concessions from the President, who is a member of the Democratic party, to satisfy their political base and longstanding convictions.

Additional information to consider:

One might ask, and they would be right to do so, who actually owns the United States’ debt? The Pew Research Center has worked tirelessly to explain and present this crisis in simple but detailed terms. In figure A (provided above) one can see that the greatest amount of public debt is held with other public investors, for a total of 58.9% ($18.2 Trillion), with the rest of the money being dispersed through various securities throughout the country. Looking deeper into the figure, critical services and hard-earned entitlement expenditures like Social Security, the Military Retirement fund, and civil service retirement and disability fund hold close to 5 trillion in debt. The Federal Government has dug the greater American community into a deep and concerning financial hole. Just so long as the Congress and the White House can come to an agreement on how to address the crisis, many will be saved from absolute economic ruin.

What does this situation mean for you, the American citizen?

Now, this is where it gets deeply troubling for the American people and the global population. If the United States Congress does not come to a meaningful, actionable, agreement with respect to raising the debt ceiling, the country risks defaulting on its debt. The basic functions of the Federal Government would collapse, life-saving payments American families rely on (Social Security) would be hindered, the public health system would be unable to function, the nation’s credit rating would be downgraded, and the financial markets would lose faith in the United States. To make a very long and scary story short… pure economic collapse would come with a U.S. default. Every American would be adversely impacted by these outcomes and even the richest among us could not escape the turmoil that would be a U.S. default. It is time for the nihilists in the House, in seats of power within the Federal Government, to get their heads out of their rear-ends and begin to engage with the White House and Democratic members of Congress to bring about meaningful action to avert this pending crisis. At the end of the day, whatever game they think they are playing, the American people are not playing it with them.

What do every day Americans know and how do they feel about this crisis?

One may be inclined to say, “I am not a recipient of Medicare, Medicaid, or Social Security, therefore, I cannot be bothered with what happens to those services.” This is a near-sighted perspective on the matter. There will come a time when citizens require these foundational services. Moving on, when engaging with everyday Americans on this matter, it could certainly be worthy of concern.

Nancy, a 52-year-old mother of two and a civil servant:

Q: Are you familiar with the Federal Debt Crisis? What do you know about the Federal Debt Crisis?

A: “I have heard a few things about it, but I am not entirely aware of the matter. For me, I have to deal with my own pressing situations and cannot be bothered by the nonsense going on.”

A response like this is not totally uncommon and that alone is worthy of concern. If the Federal Government fails to address this situation immediately, Nancy and many other parents will suffer. When she was given a bigger picture view on the matter she simply responded, “Well, then I hope our elected officials can get something done, quickly.”

Emely, a 21-year-old, college student in her senior year, and Destini, a 20-year-old, college student in her junior year:

Q: Are you familiar with the Federal Debt Crisis? What do you know about the Federal Debt Crisis?

A: “Not me,” Destini replied, turning to Emely in confusion. With great bewilderment, “Yeah, we are not sure what that is,” Emely stated.

This response, again, has not been uncommon for the situation presented to individuals throughout society. One can attribute this apathy to the many issues facing the nation and global community. One could attribute inflation, COVID-19, supply chain issues, the war in Ukraine, and political figures who promote harmful culture wars to this apathy.

The federal debt crisis is something that the average, everyday American cannot personally fix. It is the responsibility of the federal government to address this issue before it spills into a real catastrophe. Though, addressing this situation is not totally out of the hands of everyday Americans. It would be incumbent upon all to contact respective members of the House of Representatives and Senate to call on them to do their jobs and serve the people equally. Even the most financially and politically elite in the country would not be able to escape the pains of an American financial collapse.

Thanks for reading! Please check out the information below and have a great day! Feel free to reach out to us at dalenewsfsc@gmail.com

Dale News Online Publication: May 2023