-

The Decline in U.S. Consumer Confidence and Its Impact on Everyday Americans

Recently, there has been a steady drop in U.S. consumer confidence, and even though a lot of people might not think about this kind of thing, it actually says a lot about how the country is doing. In October 2025, Lucia Mutikani reported that the Consumer Confidence Index fell to 94.6, which was the lowest point in about six months, according to Reuters. It’s basically a measurement of how people feel about the economy and their own financial security, and right now the numbers show that people really don’t feel great about either of those things. When confidence goes down, it usually means people are worried about their jobs, their bills, or how far their paycheck is going to get them, and, honestly, that seems pretty accurate.

Consumer confidence matters because most of the U.S. economy is driven by regular people buying stuff. When folks get stressed out financially, they pull back. They buy fewer things that aren’t essential. A lot of families start cutting down on eating out or doing trips they planned earlier in the year. Some even start putting off things they need, like new tires or doctor appointments, because they’re afraid to spend money. Economists always talk about how consumer spending makes up around 70 percent of the economy, but when you think about it, that’s basically just millions of tiny decisions. So when surveys show that more Americans expect fewer jobs to be available soon, which went up to 27.8 percent in October, that uncertainty eventually turns into real slowdowns you can feel in your own town.

One thing the confidence reports also reveal is a growing split in how different groups experience the economy. Data might say unemployment is low or that inflation is calming down a little, but that doesn’t mean people feel stable. A lot of middle and lower income families still feel like they’re getting hit from all sides. According to Reuters, the people feeling the most pressure are the ones already struggling with paying rent or buying groceries while wealthier households keep spending like nothing’s wrong. So it’s like there are two versions of the economy happening at the same time. One where everything is fine and one where everything feels like it’s getting more expensive and stressful.

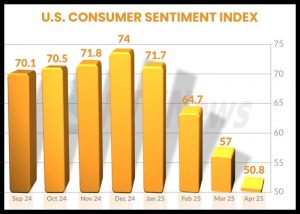

This emotional side of the economy shows up clearly in the University of Michigan’s Consumer Sentiment Index, which dropped to 50.3 in early November. That score is one of the lowest since 2022 and those kinds of numbers usually show up during major financial crises, not during periods where officials keep insisting everything is improving. It sort of proves that the country is recovering on paper but not in the way that actually affects people’s lives. A journalism story on this type of thing can bridge that gap between what the official numbers say and what people actually feel day to day.

The drop in confidence is noticeable in little everyday ways. A college student facing rising rent might pick up extra shifts but still feel unsure about whether they can afford books next semester. A family might panic a bit when grocery bills jump again even though inflation reports say the problem is better. People might skip vacations or holidays they used to take for granted. Small businesses start seeing fewer customers on weekdays or slower sales during times that used to be busy. These things don’t show up in a single headline but they add up all across the country and tell a much bigger story.

There is also a political side to all this. When people feel financially insecure, they tend to look toward whoever is in office, even if the problems come from a mix of global events and long term issues. The Federal Reserve is under more pressure to cut interest rates because higher rates make borrowing harder for everyone. Politicians also start shaping their campaigns around these worries, promising economic relief or blaming their opponents for the downturn in confidence. This makes consumer confidence not just an economic number but also something that influences how people vote and what issues they care about.

This decline also relates to other big issues happening right now like housing costs, student loan payments returning, wages not keeping up with rising expenses, and even international conflicts that make people uneasy. The economy is influenced by all kinds of events that seem unrelated at first but end up affecting confidence. After several years of inflation spikes, pandemic disruptions, and job market changes, people might just feel worn down. The fact that confidence hasn’t bounced back yet suggests something deeper is going on, like long-term frustration or the feeling that no matter how hard people work, they can’t get ahead the way previous generations did.

At the end of the day, the drop in consumer confidence is not just a technical reading. It’s a sign of how worried Americans are about their futures. Whether someone is skipping small luxuries, putting off buying something important, or stressing out about rent, these are all personal reactions that reflect a national trend. The Consumer Confidence Index reveals how the economy really feels at ground level.